8 Unbelievable How To Calculate Operating Cash Flows - To use the direct method, use total revenue and total operating expenses posted to the income statement. So don’t include investing or financing items in your calculation of operating cash flows.

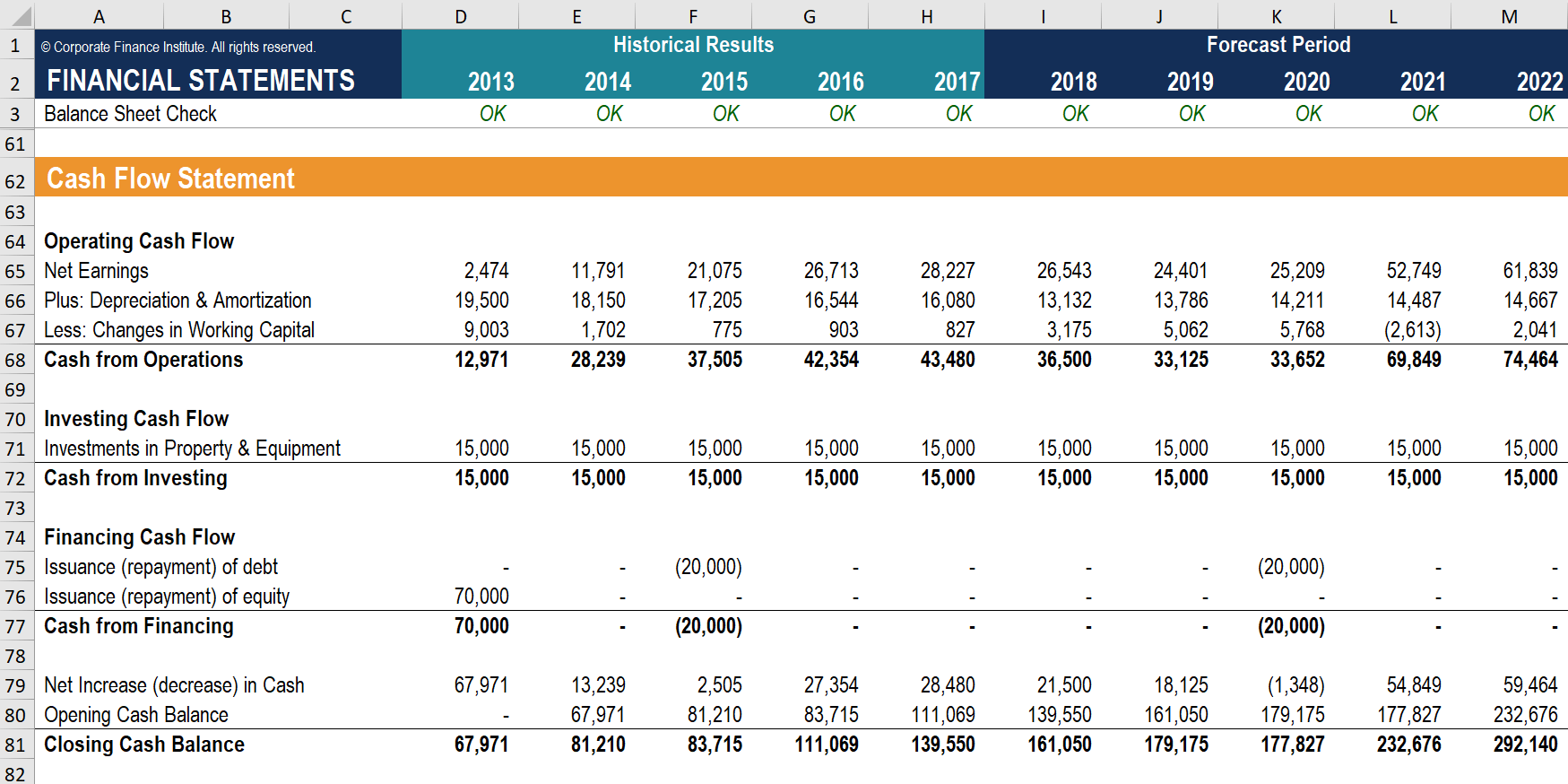

Solved Calculate The Free Cash Flows For 2008 From An Ass . How to calculate operating cash flow in excel.1) using excel calculate the operating cash flows associated with each equipment.

Solved Calculate The Free Cash Flows For 2008 From An Ass . How to calculate operating cash flow in excel.1) using excel calculate the operating cash flows associated with each equipment.

How to calculate operating cash flows

5 Success How To Calculate Operating Cash Flows. Expanded it's the end of the year and your company has its financial. Free cash flow these two types of cash flow seem similar, but they’re actually quite different. Compared to other cash flow indicators, operating cash flow ratio is the most reliable because it determines the state of a company based on real money (not borrowing). How to calculate operating cash flows

This is important because businesses can compare this information to other reporting periods. Examples of cash flow in net operating activities include the change in net income for the period as well as the adjustments to reconcile net cash provided by or used in operating activities, to. Operating cash flow is the cash that flows in and out due to the daily operations of a company that generate revenues, sell inventory, provide services, and other activities not classified as investing or financing cash flow. How to calculate operating cash flows

Certain important cash flows aren’t generally considered to be ‘operating’ cash flows. In our excel model, all the relevant figures have been calculated previously in our model, so we Just as with our free cash flow calculation above, you’ll want to have your balance sheet and income statement at the ready, so you can pull the numbers involved in the operating cash flow formula. How to calculate operating cash flows

To calculate its 2021 net cash flow, big corporation adds all three together: Learn what operating net cash flows are, how to calculate them using both the direct and indirect methods and see examples of each. Free cash flow (fcf) is cash left after a company pays operating expenses and capital expenditures. How to calculate operating cash flows

Such costs are not paid or dealt with in cash by the firm. Operating cash flow free cash flow the operating cash flow indicates the cash generated by a company’s core business operation over a certain period of time. We calculate operating cash flows using the formula: How to calculate operating cash flows

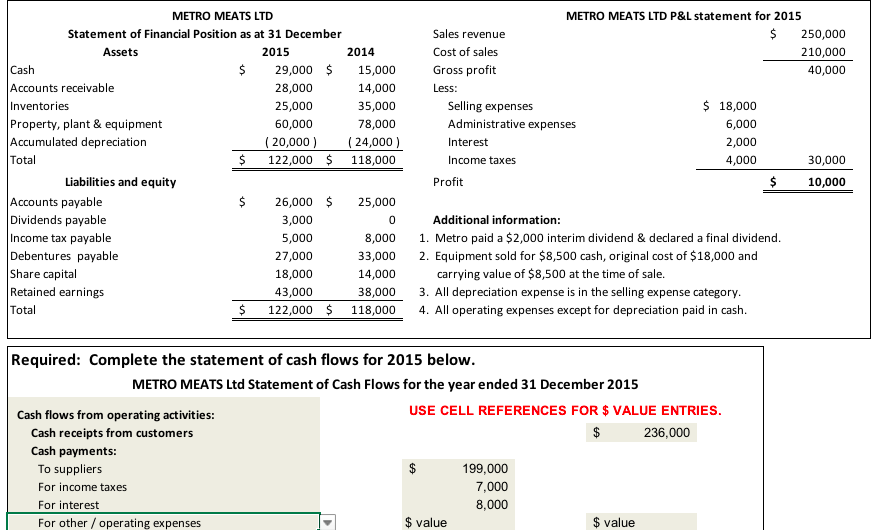

2) using excel calculate the operating cash flows resulting from replacemnet. Ncf= net cash flows from operating activities + net cash flows from investing activities + net cash flows from financial activities net cash flows from operating activities: While the direct method, which is far simpler to calculate, gives business owners a quick pulse on profitability, the indirect. How to calculate operating cash flows

In indirect method, the net income figure from the income statement is used to calculate the amount of net cash flow from operating activities. According to these calculations, big corporation made $615,000 in 2021. Operating cash flows indicate the success of a company’s business activities. How to calculate operating cash flows

Read how to calculate free cash flow to find good investments. Once you calculate the net effect of these operating cash flows using the indirect method, the final step is to apply the effect of the changes due to investing and financing cash flows. While operating cash flow tells whether a company can continue to operate on its current earnings, free cash flow tells whether a company can continue to pay off debts and dividends, or even make investments for growth. How to calculate operating cash flows

Operating cash flows concentrate on cash inflows and outflows related to a company's main business activities, such as selling and purchasing inventory, providing services, and paying salaries. Explanation now, let us see what the main steps required to calculate the operating cash flow are. The smaller the business, the less diverse your. How to calculate operating cash flows

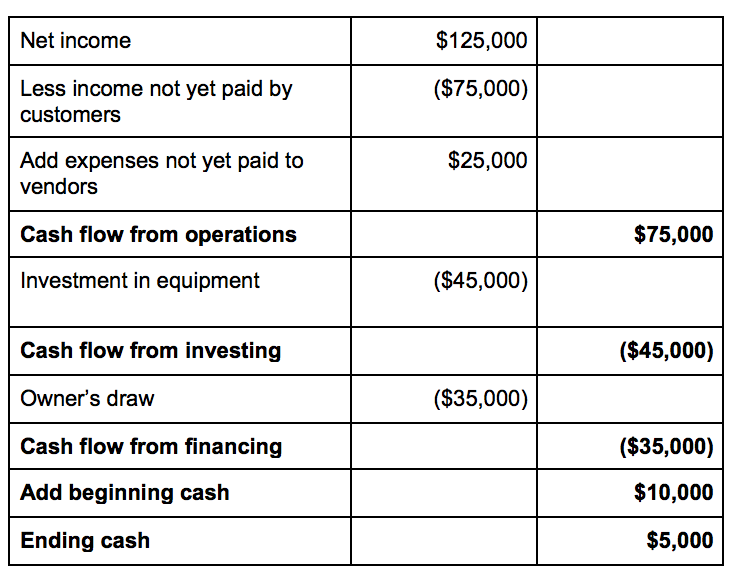

We cover how to calculate cash flow in more detail here , and show a simple example of the indirect method below: This formula is simple to compute, and it’s often ideal for smaller businesses, partnerships, and sole proprietors. Net income considered as starting point. How to calculate operating cash flows

Operating cash flow formula there are two methods for calculating ocf: Free cash flow (fcf) is the money. How to calculate cash flow: How to calculate operating cash flows

How to calculate operating cash flow: The first section of a cash flow statement, known as cash flow from operating activities, can be prepared using two different methods known as the direct method and the indirect method. How to calculate operating cash flows

An Easy Cash Flow Formula Any Small Business Can Utilize . The first section of a cash flow statement, known as cash flow from operating activities, can be prepared using two different methods known as the direct method and the indirect method.

An Easy Cash Flow Formula Any Small Business Can Utilize . The first section of a cash flow statement, known as cash flow from operating activities, can be prepared using two different methods known as the direct method and the indirect method.

How to Calculate Cash Flow 4 Steps (with Pictures) wikiHow . How to calculate operating cash flow:

Solved Use Excel To Compute Cash Flows, NPV, IRR And Pay . How to calculate cash flow:

Solved Use Excel To Compute Cash Flows, NPV, IRR And Pay . How to calculate cash flow:

How to Calculate Cash Flow 15 Steps (with Pictures) wikiHow . Free cash flow (fcf) is the money.

How to Calculate Cash Flow 15 Steps (with Pictures) wikiHow . Free cash flow (fcf) is the money.

How To Find Depreciation Expense For Statement Of Cash . Operating cash flow formula there are two methods for calculating ocf:

How To Find Depreciation Expense For Statement Of Cash . Operating cash flow formula there are two methods for calculating ocf:

Learn how to prepare a cash flow statement template in excel . Net income considered as starting point.

Learn how to prepare a cash flow statement template in excel . Net income considered as starting point.

Comments

Post a Comment